Are you considering investing in US Steel Corporation (NYSE: X), but unsure about its future stock price? This article delves into the factors that could influence the stock's future performance and provides insights into the potential trajectory of US Steel's stock price.

Understanding the Current Landscape

US Steel Corporation is one of the leading steel producers in the United States, with a strong presence in the North American market. The company operates in various segments, including flat-rolled products, tubular products, and raw materials. The steel industry has faced several challenges in recent years, including fluctuating commodity prices and increasing competition from foreign producers.

Factors Influencing US Steel Stock Price

Several key factors can impact the future stock price of US Steel. Here are some of the most significant ones:

Commodity Prices: Steel prices are highly dependent on the prices of raw materials such as iron ore and coal. Fluctuations in these prices can directly affect US Steel's profitability and, consequently, its stock price.

Economic Conditions: The global and domestic economic conditions play a crucial role in determining steel demand. A strong economy generally leads to higher steel consumption, while a slowdown in economic growth can result in lower demand and lower stock prices.

Industry Competition: The steel industry is highly competitive, with numerous domestic and international players. Increased competition can lead to lower prices and reduced margins for US Steel, negatively impacting its stock price.

Regulatory Environment: Government policies and regulations can significantly impact the steel industry. For example, tariffs and trade agreements can affect the cost of raw materials and the competitiveness of US Steel's products.

Innovation and Efficiency: US Steel's ability to innovate and improve efficiency can also influence its stock price. Continuous improvements in production processes and product development can enhance the company's profitability and market position.

Case Study: US Steel's Response to Tariffs

One notable example of how external factors can impact US Steel's stock price is the implementation of tariffs. In 2018, the Trump administration imposed tariffs on steel imports, which initially benefited US Steel by increasing the demand for domestically produced steel.

However, the long-term impact of these tariffs remains uncertain. While they have provided a short-term boost to US Steel's stock price, concerns about potential retaliation and the overall economic impact of tariffs continue to weigh on the industry.

Conclusion

The future stock price of US Steel Corporation is influenced by a variety of factors, including commodity prices, economic conditions, industry competition, regulatory environment, and innovation. While it is challenging to predict the exact trajectory of the stock price, understanding these factors can help investors make informed decisions. As always, it is crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

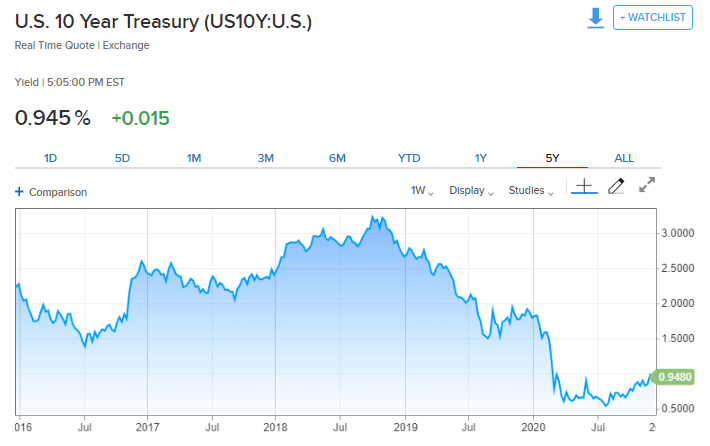

nasdaq composite